January 2, 2022

A KSCPA Ignite Blog By:

Gary Zeune, CPA | Amanda Fletcher, CPA, CFE | Eric Conforti, CPA, CFE

When an organization's environment changes, the opportunities for fraud change. However, finding fraud can feel a bit like detective work. Perpetrators almost always conceal their frauds, so their schemes may not be obvious to others in the organization. By the time the fraud is discovered, it's often too late and the money is gone.

The COVID-19 pandemic caused a sudden change to various work environments due to a rapid widespread pivot to remote work, and many individuals faced unexpected economic hardship - a perfect opportunity and rationalization to commit fraud. However, a recent study by the Association of Certified Fraud Examiners (ACFE) indicates a majority of companies have failed to change their controls to address the new risk and, therefore, financial staff and CPAs should keep a close eye out for evidence of fraud. This article will review trends and provide tips for detecting fraudulent activity.

According to an ACFE study, "2020 Report to the Nations," it typically takes a median of 14 months for fraud to be discovered. Based on this timeline, schemes that began during the early stages of the COVID-19 pandemic will likely start bubbling to the surface in the coming months.

The ACFE report lists the top schemes among 189 fraud cases in the governmental and public administration sector as:

More than one scheme was used in 35 percent of the total cases. In the ACFE's "Fraud in the Wake of COVID-19: Benchmarking Report - December 2020 edition", a significant number of survey respondents reported they'd already observed an increase in fraud in their organizations since the beginning of the pandemic, with 68 percent of respondents observing an increase in the overall level of fraud as of May 2020. That number jumped up to 79 percent in November, and 90 percent of respondents anticipate a further increase over the next 12 months.

The benchmarking lists some of the top fraud schemes observed due to the COVID-19 pandemic as:

Surprisingly, even with this significant increase in fraudulent activity during the pandemic, the survey respondents stated that their organizations aren't planning to invest more in fraud prevention. This could create a perfect storm for further increases in fraud, making it imperative that financial professionals know where to look for evidence of wrongdoing. Here are some key areas.

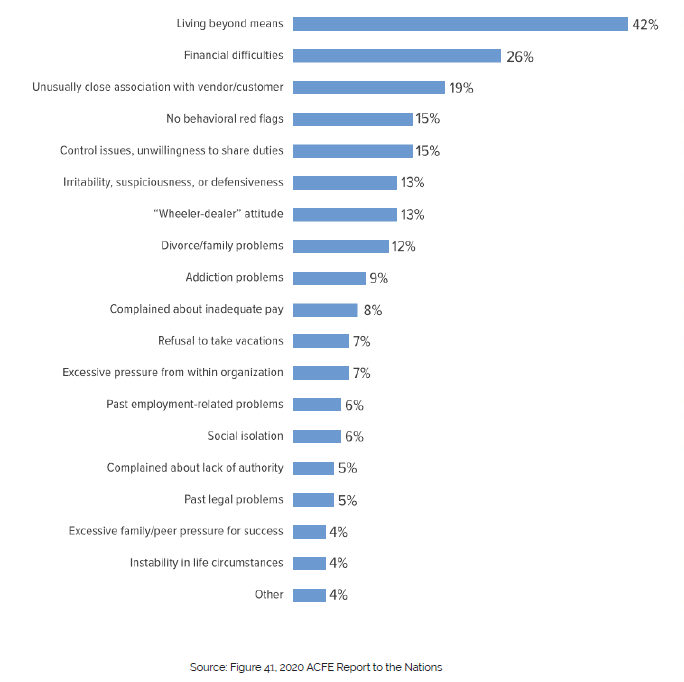

When committing fraud, perpetrators typically display behavioral red flags. The "2020 Report to the Nations" states that the most common behavioral red flag is an employee living beyond their means, which has been consistent in all ACFE surveys since 2008. Other common behavioral red flags include financial difficulties, an unusually close relationship with a vendor/customer, and control issues and an unwillingness to share duties, as shown in the graph above.

The number of fraudsters: Single perpetrators were involved in 49 percent of the schemes, with the remaining schemes involving two or more people.

Data analytics is a valuable tool to fight fraud. While data analytics can't prove fraud, it can guide you in the right direction. Analytics can be proactively performed on a periodic basis (such as quarterly); or, if there's a suspicion of fraud, it can help identify areas to focus an investigation.

Using data analytics to discover fraud doesn't necessarily require expensive or specialized tools; a wide variety of simple yet effective analytics can be performed using Excel. For example, a PivotTable is a powerful tool for summarizing data and identifying anomalies. It can be used to summarize and display payroll data such as hours worked or total pay by employee, enabling you to observe trends over a period of time. Likewise, slicing and dicing data in Excel can find employees who submit the same receipt on multiple expense reports.

Identifying problematic invoices using analytics can save significant time over manually reviewing all vendor invoices in an investigation. PivotTables can be used to summarize disbursements to vendors or display the highest-paid vendors by year to understand if the disbursements align with anticipated operations for the organization. And detecting misalignment can often uncover more suspicious activity. For example, if your entity is giving an increasingly larger percentage of purchases to a vendor, it sometimes indicates a kickback scheme.

Sorting data in Excel and using formulas can identify sequential invoice numbers within a vendor invoice listing. Sequential invoice numbers over a span of several months may show the vendor doesn't have any other customers, indicating potential fraud and organizational risk. Additional data tests include analyzing invoice data for duplicate invoice numbers, varying invoice number formats, and out-of-date sequences. Invoice numbers are often a good starting point when reviewing for anomalies, as they're not something traditionally reviewed in an audit.

When reviewing supporting documentation, such as vendor invoices or employee expense reimbursement receipts, pay close attention to the details. As previously noted, perpetrators almost always take steps to conceal their scheme, oftentimes altering or forging documentation. Review documentation for formatting differences, missing information, or numbers that don't add up - all potential indicators that documents have been altered. For example, when Rita Crundwell, a former employee of Dixon, Ill., stole $53 million from the city over the course of 20-plus years, no one noticed misspellings on the invoices, invoices with dates that don't exist such as Nov. 31, and logos and phone numbers missing from the invoice's letterhead.

Due to the increase in remote work during the pandemic, some organizations have had an increase in expense reimbursements for employee-purchased items such as home office equipment. This has created a new opportunity for fraudulent submissions. When altering or creating fraudulent receipts, an individual will often remember to change the total but may forget to recalculate the tax or subtotal, so verify that all the numbers tie together.

Similarly, when examining vendor invoices, look at multiple invoices from the same vendor. This can help identify issues like an invoice appearing to be photocopied or design differences. It's much easier to spot a fake invoice if you know what a real invoice looks like. Having multiple invoices side by side can significantly increase your organization's efficiency in spotting anomalies.

Those stealing profits or funding will likely avoid providing financial professionals or auditors information that proves their problematic activity. When brainstorming your investigative strategy, think not only about what types of information exist within your organization, but also about external third-party information that you may be able to access.

Organizations are often reluctant to reach out to third parties to obtain information because they trust the employee and their work. Yet, trust is a feeling - not a control - so it's important to detach emotionally and keep things in perspective as you look into potential fraud.

It's essential to establish a mechanism for employees to report tips, both for discovering fraudulent activity and creating an environment in which potential fraudsters know they won't be able to commit fraud undetected.

Employees who notice unusual behavior from coworkers, such as having unusually close relationships with vendors, can feel intimidated about approaching a superior with information. A hotline or anonymous email account can be used by employees to report undisclosed tips. It also sets the tone that fraud won't be tolerated in the organization.

Changes in the economy and working environment over the course of the pandemic have increased the risk of fraud significantly. Employees must be aware of commonly occurring fraud schemes and know where to look for evidence of fraud. Paying close attention to common schemes and indicators of wrongdoing will help your organization discover and stop fraudulent activity sooner rather than later.

ABOUT THE AUTHORS

Gary Zeune, CPA has more than 45 years of experience in auditing, corporate finance, and investment banking. He provides CPAs, attorneys, and executives with hands-on experience in fraud, ethics and corporate strategy performance improvement. More than 20,000 professionals have attended his classes since 1975. Email Gary at gzfraud@TheProsAndTheCons.com.

Eric Conforti, CPA, CFE is a principal with Plante Moran's forensic accounting services group, specializing in providing forensic investigations, data analytics, and fraud-focused internal control analyses. Eric is professionally trained in a variety of interviewing and interrogation methods, performing data analytics, reviewing financial records, researching persons' backgrounds online, and analyzing supporting documentation for anomalies. Eric has identified millions in losses due to asset misappropriation. Contact Eric at eric.conforti@plantemoran.com.

Amanda Fletcher, CPA, CFE is a senior manager with Plante Moran's forensic accounting services group, specializing in forensic investigations, data analytics, and fraud-focused internal control analyses. Amanda has helped organizations across a variety of industries detect fraud and quantify losses. She's also professionally trained in interviewing and interrogation methods, and data analytics tools including Excel, Idea, Tableau, and Alteryx. Contact Amanda at amanda.fletcher@plantemoran.com.

The Ignite blog is an official publication of the Kansas Society of CPAs, Copyright 2021. Reprinted with permission.

THANK YOU TO OUR SPONSORS & PARTNERS IN ACCOUNTING EXCELLENCE!

|

|

|

|

Would you like to showcase your business by sponsoring the Ignite blog? Click here for more information.

© Copyright 2026 KSCPA | All Rights Reserved